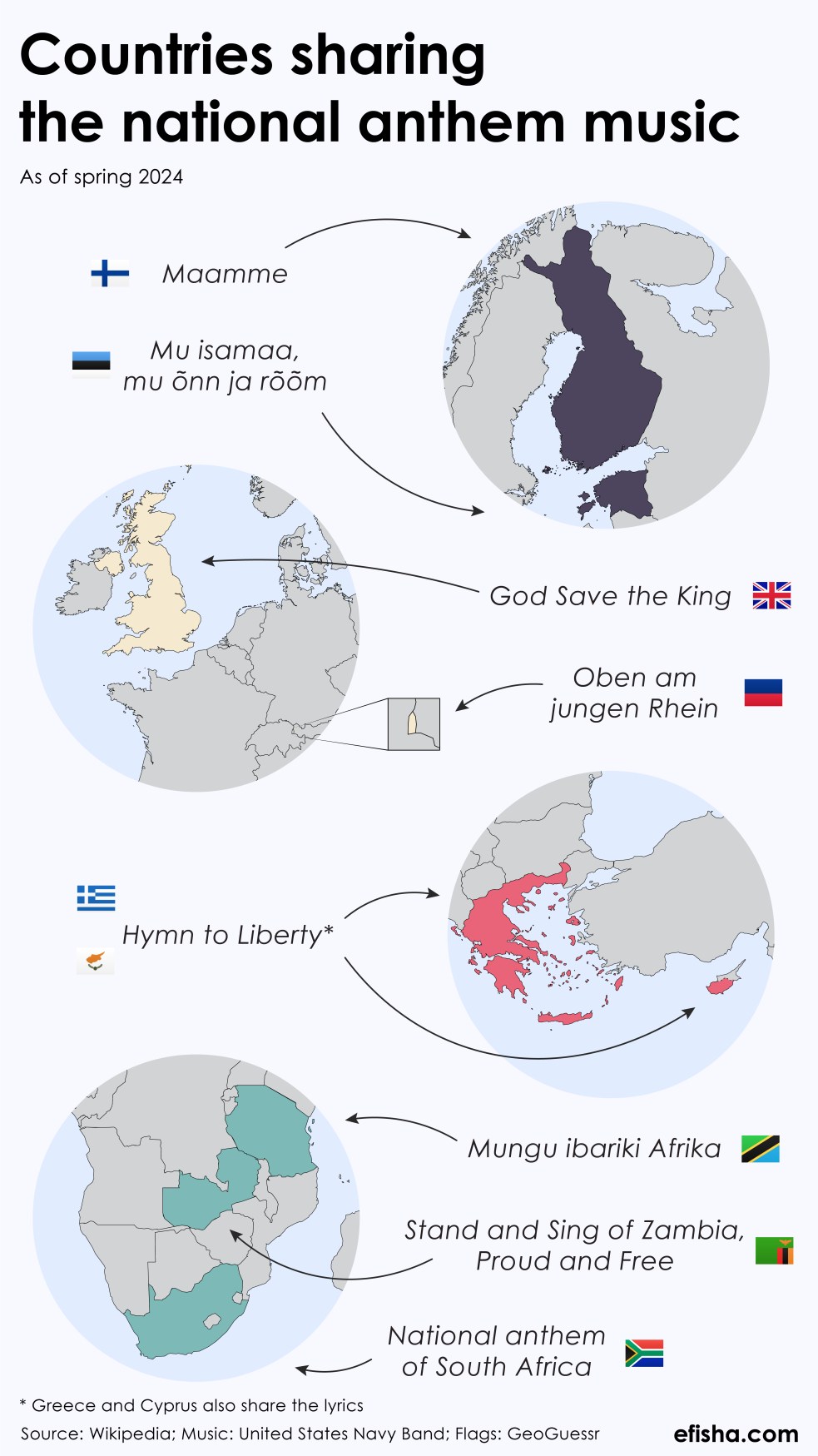

Not all countries have their own unique anthem. Some share the music and the pair of Greece and Cyprus even share the lyrics! In the 19th century, the situation was even less diverse. Not only because there were fewer countries and half the world basically belonged to a handful of them, but also because of the British anthem. As one might expect, it was used throughout the empire. As one might not expect, the music to it has also been used by Russia, Sweden, Iceland, Siam, Greece, Hawaii, Prussia, Hanover and Saxony at different moments.

Nowadays, some might also say that Chilean and Bolivian anthems sound strikingly similar, but officially they are 2 different melodies composed by 2 different people.

If you know any other national anthems that share the music or you want to share or ask something, send me a message using the contact page.